You’ve done your homework, and now you’ve got this retirement stuff all figured out. Savings socked away. Debts paid off. A plan in place to transition from work to leisure. Let the good times roll!

However, some retirement mistakes operate under the radar.

Maybe they’re due to that heady rush of freedom in the first year of retirement. Perhaps you want to keep being generous, forgetting that you now have less money. And as we age, certain physical issues can make it harder to be frugal, and certain cognitive changes can lead to poor decision-making.

Here are some unwise decisions that could tank your golden years, and how to avoid them.

1. Forget to create/update legal documents

When was the last time you looked at your will and estate plan? Things change, and our legal paperwork needs to change along with them.

Maybe a grandchild was recently born, or your sibling died last year. Possibly the son who’d agreed to be your executor no longer feels up to the task.

Or perhaps during the pandemic, you had to sell some of the jewelry you’d planned to leave to your great-niece. If so, make sure those pieces aren’t included in the will, or whoever does end up as executor might pull their hair out trying to track down these mysterious baubles.

And if, heaven forbid, you don’t have a will or estate plan, get going on this yesterday. You’ll find help at “8 Documents That Are Essential to Planning Your Estate.”

2. Fail to budget

You’re on a fixed income now, remember? Some costs do go down in retirement. That 40-mile commute will be a thing of the past, and you won’t need to buy and maintain a work wardrobe. But other costs might go up. For example:

- Medical bills. Sorry to have to tell you this, but Medicare doesn’t cover everything. Among other things, you could have to pay for glasses, hearing aids and most dental work, depending on what Medicare coverage you choose.

- Household help. If you can no longer do yard work or deep cleaning, you’ll need to ask for assistance. Your grown kids are pretty busy with their own lives, so you can’t expect them to use one of their precious days off each week doing outside chores plus your cleaning and laundry. That means this could be a new bill to add to your budget.

- Food. If health issues require specialized diets, the ingredients could get costly pretty quickly. And if those health issues make it tough to cook, you might wind up relying on takeout or meal delivery services, which are much more expensive than from-scratch meals in your own kitchen.

- Home modifications. Illness or the cumulative aging process might create the need for things like grab bars in the bathroom or a wheelchair ramp out front.

This doesn’t mean you’re doomed. It just means you need to live within a reasonable budget, just as you did when you were working. Keep an eye on monthly spending, either with paper and pen or a service like YNAB (You Need A Budget), which simplifies the process (and automates it to boot). In addition, companies like Rocket Money make it easy to find and cancel memberships and subscriptions you’ve decided you can live without.

Spending creep could cause you to take too much out of your retirement accounts or to go into debt because you’re afraid to tap those accounts. Neither one is a good look. If this might be a concern for you, check out “5 Ways to Stop Lifestyle Creep From Stealing Your Retirement.”

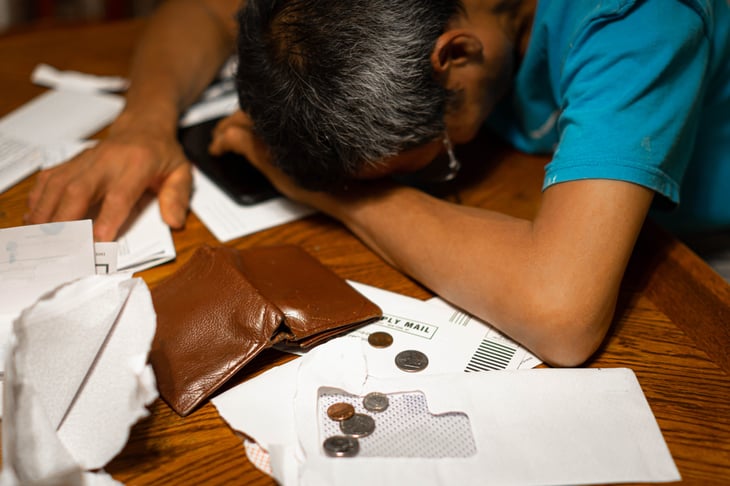

3. Slide into debt

Ideally, you’ve planned to go into retirement with zero debt. But it’s all too easy to slide back in, especially if you haven’t created that budget — one that takes into consideration the fact that you’re now on a fixed income.

If you find you have more month than money, it’s time to identify the financial leaks. This likely means making some choices, such as cutting one of your streaming services or cooking more rather than ordering in.

Some overages are one-offs: wedding or graduation gifts, trips to see family, a car repair, an emergency loan to a relative. Others, such as insurance premiums or property tax hikes, are to be expected (but are never fun when they arrive). However, all these things should be factored into your spending plan, under categories such as “emergency fund,” “vacations” and “giving.”

If you’re carrying debt that is overwhelming you, however, consider talking to a reputable credit counselor.

4. Spend fixed income on grown kids

Naturally, we want our offspring to live their best lives. Sometimes, however, helping them could jeopardize our own long-term comfort and security.

For example, it’s increasingly common for young people to live in the family home well into their 20s and even their early 30s. Sure, some of them offer to pay rent — but some parents refuse to accept it.

And ask yourself this, parents: Do you regularly drive the “kids” around or let them use your car, pay for their groceries or grab the tab at restaurants? Do you carry your offspring on your phone plan for free or cover the cost of additional streaming services so everyone is happy?

Even when children are out on their own, parents often still help out. According to the Pew Research Center, parents are stepping in to cover both money emergencies and basic expenses such as utilities or even mortgages.

As the flight attendants say, you must put on your own oxygen mask first. Before you help your kids, or your grandkids, take a hard look at your own finances: Can you truly afford to subsidize everyone indefinitely?

Sound harsh? Here’s what’s harsher: Having to contact those adult kids a decade from now to say, “I can’t make my basic bills. Can you send me some money? Or can I come live with you?”

Harshest of all: The possibility that your offspring might not be able to help you, which means you could be facing extreme poverty in your final years.

5. Withdraw too much money

Once you’re retired, you might want to do a little of everything. After all, you no longer have to schedule time off for vacations, spa days and the like. Finally, you can buy season tickets to your favorite sports team or subscriptions to theater or dance companies. You can take riding lessons, splurge on fancy kitchen equipment, or beef up your collection of power tools.

But can you, really?

If you claimed Social Security before your full retirement age, you’ll have permanently reduced benefits — and the conventional wisdom is to take no more than 4% out of your accounts each year. Out-of-control spending may cause you to loot your retirement funds faster than you should.

Then there’s the possibility (likelihood, really) of a market downturn during your golden years. With your retirement funds worth less, withdrawing that 4% means the fund will diminish faster.

Having a decent-sized cash cushion can help because it lessens the amount you’ll need to withdraw. Having a sensible budget that allows for some fun — but not all the fun at once — helps too.

6. Become sedentary

Plenty of people dream of taking it easy in retirement. But you don’t want to take it too easy. A lack of exercise can lead to all sorts of health issues. The National Institute on Aging, part of the U.S. Department of Health & Human Services, reports:

“Often, inactivity is more to blame than age when older people lose the ability to do things on their own. Lack of physical activity also can lead to more visits to the doctor, more hospitalizations, and more use of medicines for a variety of illnesses.”

Being active improves energy, physical strength, balance and sleep. It can help you reach or maintain a healthy weight, reduce stress and anxiety levels, improve cognitive function, and manage or even prevent certain diseases. Taken together, all these improvements could make it possible to live independently for longer, or maybe for the rest of your life.

Vowing to stay active isn’t enough. You need an actual plan in place, such as a daily mall-walking date with friends or a YMCA or health club membership. Recreation centers and colleges could also be sources for affordable exercise options.

Note: Silver Sneakers, a wellness program included free with many Medicare plans, can set you up with fitness videos, live online classes or in-person workouts at more than 15,000 locations nationwide.

7. Let yourself become isolated

Some people do pretty well on their own, for a time. But prolonged isolation can lead to some serious physical and mental health issues, according to the National Institute on Aging. Among them: depression, anxiety, cognitive decline, high blood pressure, obesity, weakened immune function and heart disease. According to the NIA:

“Older adults are at higher risk for social isolation and loneliness due to changes in health and social connections that can come with growing older, hearing, vision, and memory loss, disability, trouble getting around, and/or the loss of family and friends.”

What to do? Depends on what you like to do. The NIA suggests solutions like volunteering, auditing classes at a college or university, adopting a pet (if you’re physically able), joining an exercise class, restarting an old hobby or taking up a new one, visiting a senior center or the library regularly, staying in touch with family and friends via video chat or other technology options.

8. Always pick up the check

Parents often grab for the tab automatically, somehow assuming their adult offspring are not yet financially secure. Or they fight with their friends to be the one who pays, either out of genuine affection or supremacy issues.

Stop doing this. Show your love in other ways. Let family and friends know that in honor of your fixed income you will now be asking for separate checks. Or stage a potluck at your house.

9. Fail to ask for senior discounts

My partner and I always shop on Senior Day at Kroger because we get 10% off all store brands and on Senior Tuesday at Walgreens, where we get 20% off.

A friend’s dentist offers discounts for those older than age 65. Being over 55 gets us senior movie ticket deals. Other retailers and service providers might also give you a price break — but you won’t know unless you ask. So ask.

10. Lend money

Sometimes it’s okay, because you know the person is good for it. But sometimes you’ll get stiffed by a relative or friend.

Money Talks News founder Stacy Johnson offers best-practice tips in “Should I Lend Money to My Kids?” (For example, everything should be in writing.)

Remember: They say never to lend more than you can afford to lose. They’re right.

11. Answer the phone

When “unknown caller” or “out of area caller” shows on the phone display, my partner and I let the machine get it. Nine times out of 10 the caller hangs up; those who leave messages are invariably someone wanting our money.

Let voicemail get it, lest you be talked into giving to your alma mater or double-talked into some kind of scam. And if you’re wondering whether a request is legit, get a second opinion.

12. Give too much

They say it’s more blessed to give than to receive. But suppose your giving gets out of hand?

Instead of wrecking your own finances, make “charitable giving” part of your budget. Maybe that’s a specific percentage, such as a 10% church tithe. Or maybe you’ll look at the numbers and decide, “I can afford to give away $100 a month.”

Once you’ve reached that amount, stop. Yes, it can be hard with so many emails, social media postings and relatives’ kids selling band candy.

Note: If you find it hard to say “no” in the moment — and who can resist a little tuba player with a box of chocolate? — then set aside part of your giving budget for these spur-of-the-moment requests.

And before you decide to give to a cause, check it out through websites like GuideStar or Charity Navigator. You’ll get an idea of how much of the money actually goes toward helping others. For a smaller or new charity, go to its website to look for an IRS 990 Form, which spells out salaries and expenses.

It’s good that you want to give. But you need to take care of yourself before you can help anyone else.

13. Assume you won’t need long-term care

It’s tough to think about declining health. But we do need to think about it. If you’re 65 right now, there’s about a 70% chance you’ll need some kind of long-term assistance one day. Of course, that means that 30% of us won’t need it – but we can’t know in advance which group we’re in.

That’s why we need to plan. Don’t assume that Medicare will pay (generally it won’t, unless you have certain medical conditions), or that Medicaid will step in to save the day. Instead, think about options such as:

- Long-term care insurance to cover the wildly expensive cost of this care (a portion of the premiums may be tax-deductible)

- Modifying your home to age in place

- Moving to a senior community with both independent and assisted-living options

- Talking with a family member about moving in if you can’t manage on your own

None of this is easy, but it’s absolutely necessary. Long-term care can be very, very expensive. Better to have a plan in place than to try and come up with one on short notice.

14. Ignore inflation

If you think inflation hurts now, wait until you’re no longer earning.

The purchasing power of your pension, Social Security and any other income sources will be eroded every year. Ever notice the number of older or even elderly people still in the workforce? As reported in “10 Reasons Today’s Older Workers Are Delaying Retirement,” inflation-related issues made up three of the 10 reasons that people are afraid to quit their jobs.

Not everyone wants to work past age 65 – and no one should count on doing so. That’s why it’s important to get ahead of the situation.

A little pre-retirement planning should cover topics like diversifying some of your cash savings (while still keeping enough for at least a year’s worth of bills), making sure that your investment portfolio is properly allocated with regard to your retirement horizon and, yes, considering putting off retirement or working a little bit while retired.

If you haven’t already done so, talk about your post-work life with a qualified financial planner. Don’t have one? A free service like SmartAsset will help you find a fiduciary in your region.

15. Fail to plan ahead for RMDs

The good news: The age when you must start taking required minimum distributions (RMDs) from your retirement account has gone up. It’s currently 73 and will go up to age 75 in 2033.

The potentially bad news: If you fail to plan ahead, you could wind up owing money on that withdrawal. Combined with other income sources, the RMD could potentially cause your Social Security to become taxable, and in some cases, potentially nudge you into a higher tax bracket, affect Medicare premiums or even trigger the Medicare surtax.

Here are a couple of ways to reduce the pain:

Donate the RMD. Those aged 70½ or older can opt for a “qualified charitable distribution,” which means donating up to $100,000 from a traditional IRA to a 501(c)(3) nonprofit. You don’t need to itemize in order to make this distribution.

Convert your IRA to a Roth. If you haven’t yet reached age 72, consider the switch because Roth IRAs don’t require RMDs. You will owe taxes on the money that you convert, but it could work out in your favor.

Don’t even think about skipping an RMD in retirement or skimping on the amount you withdraw. Doing this means a 25% tax bill on the money you didn’t take out but were supposed to.

16. Eat a lot of highly processed foods

The older we get, the more we want (or need) to simplify certain tasks. Shopping, cooking and kitchen cleanup require a fair amount of physical labor, which some retirees simply can’t manage (especially if they’re caregivers for spouses or partners). Too, some people take retirement seriously, i.e., “I will no longer do things that I don’t want to do” – such as shopping, cooking and cleaning up. And some elders who become addicted to junk food report being lonely and in fair or poor physical or mental health.

Eating too much highly processed food may be linked to a higher risk of dementia, according to a study published in the journal Neurology.

A separate study, published in JAMA Neurology, suggests a connection between large amounts of highly processed foods and a faster rate of cognitive decline.

So does your Funyuns habit mean you’re doomed? Not necessarily. Neurology reports that cutting highly processed foods by even 10% in favor of unprocessed (or minimally processed) foods is linked to a 19% drop in dementia risk.

Introducing more “whole” foods now, as well as reducing dependence on fast food and sugary/salty/fried snacks, could help you build a healthier retirement later on.

Now is also a good time to investigate other cooking options. For example, an Instant Pot can cook delicious meals in a fairly short amount of time, and is great for those on special eating regimens (e.g., vegetarian or paleo). It can also save you a ton of money and works well for batch cooking, which means a freezer full of healthy alternatives to takeout.

17. Stop challenging your mind

A long-term study of more than 29,000 seniors in China indicates that an actively engaged mind is vital for slowing memory decline. In other words, no vegging out in front of the TV or playing games on your phone all day long.

Not that screens are entirely verboten. Computerized crossword puzzles were found to help seniors with mild cognitive impairment, according to one study. Computer games also worked well initially, but crosswords ultimately provided more benefits over time.

The China study suggests that to improve brain function and reduce memory loss, seniors should spend time reading, writing and – you guessed it – playing games at least twice a week. About that last: Playing games with other people, rather than on a computer or phone, would have the additional benefit of socialization.

Incidentally, a great way to challenge your mind in retirement is to volunteer in the community. Volunteers report a sense of satisfaction from helping while also beating the isolation that affects many seniors.

18. Keep all your vehicles

The average annual cost of car ownership is now $12,182, according to AAA. What could an extra $1,015 a month do for your bottom line?

Retirees who live in areas with good public transportation and/or senior transit options may not need two cars. Or even one, if they’re in super-walkable neighborhoods – doing errands on foot means exercise and socialization.

Not everyone lives in a walkable area and public/senior transit doesn’t exist everywhere. Even so, sometimes one car is all that’s needed. Online shopping/local delivery options make it easier than ever not to have to drive somewhere for groceries and other goods. On days when plans conflict, the money saved by having one car can pay for a ride-share or the $20 for the grandkid who takes you where you need to go.

Note: AAA’s Your Driving Costs Calculator could help you decide which car to keep. This state-by-state tool lets you enter info on your driving habits along with the make and model of the car.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.