Editor’s Note: This story originally appeared on My Stock Market Basics.

Series I savings bonds, or I bonds, are by far the best opportunity in investing right now. Where else are you going to get a guaranteed return of 7% to 10% a year along with protection from both inflation and a stock market crash?

And yes, that is a guaranteed return paid by the U.S. Treasury. That might sound too good to be true, but it is because if the government stops paying on its savings bonds, well, money will be the least of your problems — I’m in the bunker at that point.

In fact, Series I savings bonds are such a great investment right now that the government is limiting who can invest in them and how much you can buy.

So I’m giving you a complete guide on I bonds, from interest rates to how to buy them with no fees.

What are I bonds?

Series I savings bonds were started in 1998 to give investors a way to protect their money from inflation while still providing that guarantee of a U.S. government bond.

All bills, notes and bonds issued by the government are essentially just loans to the government, and the interest rate on most of them is just pathetic.

Regular Treasury bills, notes and bonds will pay you just 3% a year to lock up your money for 30 years. Even on the Series EE savings bond, which doubles in value after 20 years and pays a 0.1% annual yield, the return works out to just 3.6% a year.

Uncle Sam is a cheapskate!

But Series I bonds are an exception.

Series I savings bonds explained

The power of the I bond goes beyond that high yield. You see, the biggest problem in investing right now is that with all the stock market uncertainty, there’s no place for safety.

Normally, investors would rush to the safety of bonds or cash to protect their money from a market crash, but increasing interest rates are destroying the bond market.

The Vanguard Long-Term Bond Fund (BLV) has lost more than 21% of its value in less than five months. And cash, with inflation at 40-year highs, is a guaranteed loss. You’re losing more than 8% for every year that cash sits in your bank account.

Not only is the return you earn on Series I bonds guaranteed, but it includes an inflation kicker to protect your money.

I truly believe I bonds are exactly what investors need right now: a guaranteed, high-yield investment that can protect your money from a stock market crash.

Who is on I bonds?

Most government bonds just show a bunch of dusty old white guys. I mean, sure, you wrote the Declaration of Independence, but what have you done for me lately?

One of the coolest things about I bonds is that they feature some of the greatest and most inspirational Americans, from Helen Keller to Dr. Martin Luther King Jr., Chief Joseph, Gen. George C. Marshall and ol’ Al Einstein himself!

How do I bonds work?

You buy I bonds directly from the Treasury. (More on that in a minute.)

You can buy any amount from $25 to $10,000, and the bonds earn interest every month. Every six months, the interest is added to your bond, so you start earning interest on that interest — compound interest — another great feature you don’t get with other bond investments.

The overall interest rate paid on I bonds, known as the composite rate, is made up of two parts.

The first is a fixed interest rate you get for as long as you hold the bond, and that’s locked in when you buy it. The fixed rate is set for new bonds every six months, and it’s not much, but it can help boost the overall rate you get.

The other part of the composite rate is the inflation kicker that makes I bonds such a great investment when prices start heating up. The inflation kicker is set every six months based on the Consumer Price Index (CPI), which measures the inflation on things we buy, from groceries to gas and rent.

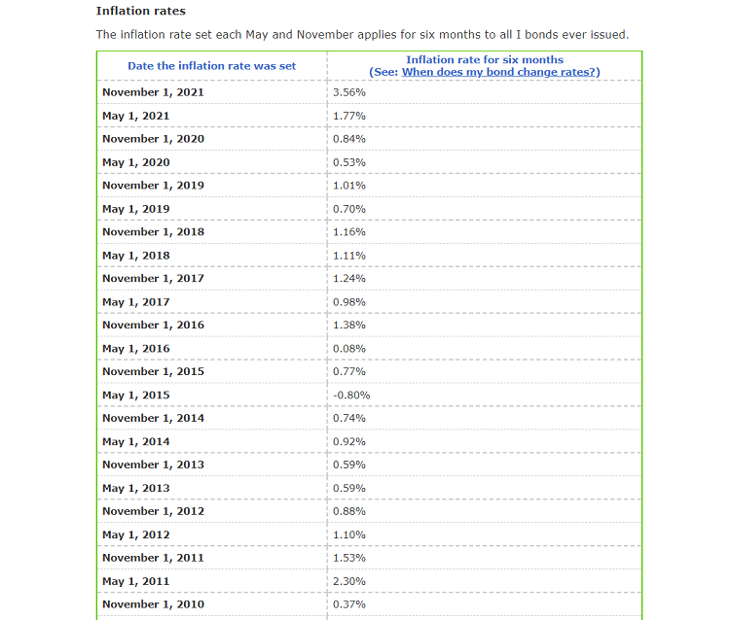

Below you see the inflation adjustments and how they really started to go up over the last year along with the surge in inflation.

Series I bond composite rates

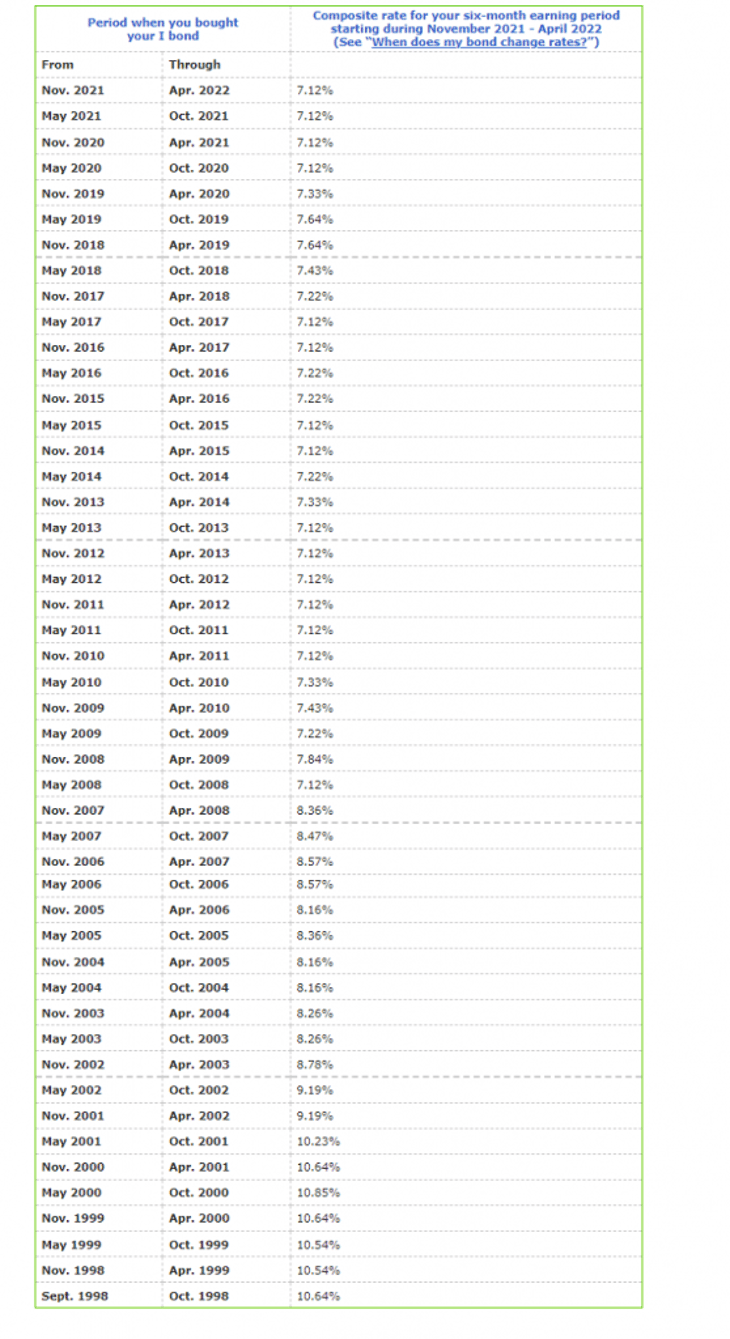

The next chart shows the composite rates paid on Series I bonds going back to 1998.

What’s amazing here, though, is that I bonds were paying more than 7% even before inflation started to become a problem last year. That tells me that even if inflation comes down a little, you’re going to be making 8% or more on these for years.

Are I bonds a good investment?

Not only are I bonds a good investment based on that historical composite rate, but also the fact that they offer a guaranteed return.

With that stock market uncertainty and the potential for a recession, you need some kind of bond investment in your portfolio, but bonds haven’t provided the safety they’re supposed to all year.

I bonds are a perfect addition to your core-satellite strategy, substituting the bond portion of your portfolio for savings bonds and that safe, high-yield return.

Pros and cons of I bonds

There are some downsides to I bonds, so I want to compare the pros and cons so you can see them side-by-side.

We’ve covered the pros of I bonds already:

- High yield

- Inflation protection

- Stock market crash protection

- Guaranteed return

There are two downsides to I bonds.

First is that the inflation kicker changes every six months. The Treasury will calculate the new inflation rate based on consumer inflation and will adjust this part of the yield accordingly every six months. So if inflation starts falling, then the yield on I bonds will fall as well.

Realistically, though, the composite rate on I bonds is going to be higher than 8% for the next year at least.

That brings us to the other drawback of savings bonds, the lockup period. You have to hold your I bonds for a minimum of one year and will pay an interest penalty if you sell before five years.

Now, this isn’t nearly as bad as it seems. With the Federal Reserve expected to continue increasing rates for years, I think investors will need the protection of I bonds for well over a year.

The penalty for selling I bonds within five years isn’t that bad, either: You lose the last three months’ worth of interest.

For example, if you hold an I bond for 18 months at a 9.5% annual interest rate, you’ll still earn an annualized 8.9% return on the investment, even with the three-month penalty.

How to buy I bonds

You buy I bonds or any savings bonds directly from the Treasury — specifically, TreasuryDirect.gov — so there are no fees and all your information is protected.

Buying Series I bonds on TreasuryDirect is a super-easy process — and I walk you through it step by step in my I bond video.

If you haven’t already, you’ll first need to open a TreasuryDirect account. For a government website, it’s actually pretty easy to use.

Once you have set up your account, you’re ready to buy a savings bond.

Series I bond limits

On TreasuryDirect, you can buy I bonds in any amount from $25 to the $10,000 annual limit, making a one-time purchase or scheduling repeat purchases.

You’re limited to investing $10,000 a year in I bonds through TreasuryDirect, and up to $5,000 a year in paper I bonds using your federal income tax refund.

You also need to be a U.S. citizen or resident with a Social Security number to buy I bonds.

Of course, that limit doesn’t mean you can’t buy $10,000 worth every year and just keep accumulating I bonds for as long as you want that high yield.

How to gift I bonds

Another great feature of TreasuryDirect is that you can gift I bonds to someone. I set up a TreasuryDirect account for my wife and both kids, gifting each the limit to get that high yield on $40,000 in total.

Each person has that same $10,000 purchase limit for electronic bonds, and when you gift, it goes against the recipient’s purchase limit, not yours.

Taxes on I bonds

Now, you knew we had to talk about taxes because Uncle Sam is always going to get his … which is pretty messed up if you think about it: The government is going to collect taxes on interest it paid you for loaning the government money.

But Uncle Sam isn’t a total hypocrite. You’ll owe federal income taxes on the interest but won’t have to pay state or local taxes on it. That’s better than most stocks or bonds, on which you pay taxes at the state and local level.

You also won’t owe the taxes on your I bond interest until you sell the bonds and collect your interest, potentially deferring the taxes on your bonds for years.

The Series I savings bond is one of the best opportunities for investors right now, simultaneously helping you to manage inflation as well as protect you from a stock market crash. It’s one of the highest interest rates you’ll find in bonds and a good investment.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.